Understanding of financial information means analysis of numbers, financial terms and organized data as tables for useful insight. It requires math calculations and knowledge of financial concepts, rules and relationships between economic terms. Although sophisticated AI Models have shown excellent general reasoning, their suitability for financial tasks is questionable. Such tasks require more than simple mathematical calculations, as they involve interpretation of domain -specific vocabulary, recognition of the relationship between economic points and analysis of structured economic data.

Generally to Reasoning as Chain-of-thoughts Fine tuning and reinforcement learning increases the benefit of several tasks, but collapses with financial justification. They improve logical reasoning, but cannot repeat the complexity of economic information that requires numerical understanding, knowledge of the field and data interpretation in an organized way. While large language models are widely used in financing for tasks such as sentiment analysis, market prediction and automated trade, general models are not optimized for financial reasoning. Finance -specific models such as Bloomberggpt and Fingpthelp understand financial conditions, but still face challenges in reasoning of financial documents and structured data.

To solve this, scientists from Thefinai proposed Fino1an economic reasoning model based on Llama-3.1-8b-Instruct. Existing models struggled with financial text, table -shaped data and equations and showed poor results in long -context and multi -table. Simple data set improvements and general techniques such as Cot Fine tuning could not bring uniform results. This frame used reinforcement learning and iterative Cot Fine tuning to improve the financial reasoning, the refinement of logical steps and decision -making accuracy. Logical sequences were systematically built so that the model could analyze financial problems step by step, and verification mechanisms tested reliability to determine correct financial conclusions. Two-stage Lora Fine tuning solved contradictions in numeric reasoning and equation solution, with the first step fine -tuning of the model for financial principles and the second step fine tuning in intricate calculations. Organized training on various financial data sets, such as reports and tabular data, improved the interpretation to provide more accurate accounts and transaction registration analysis.

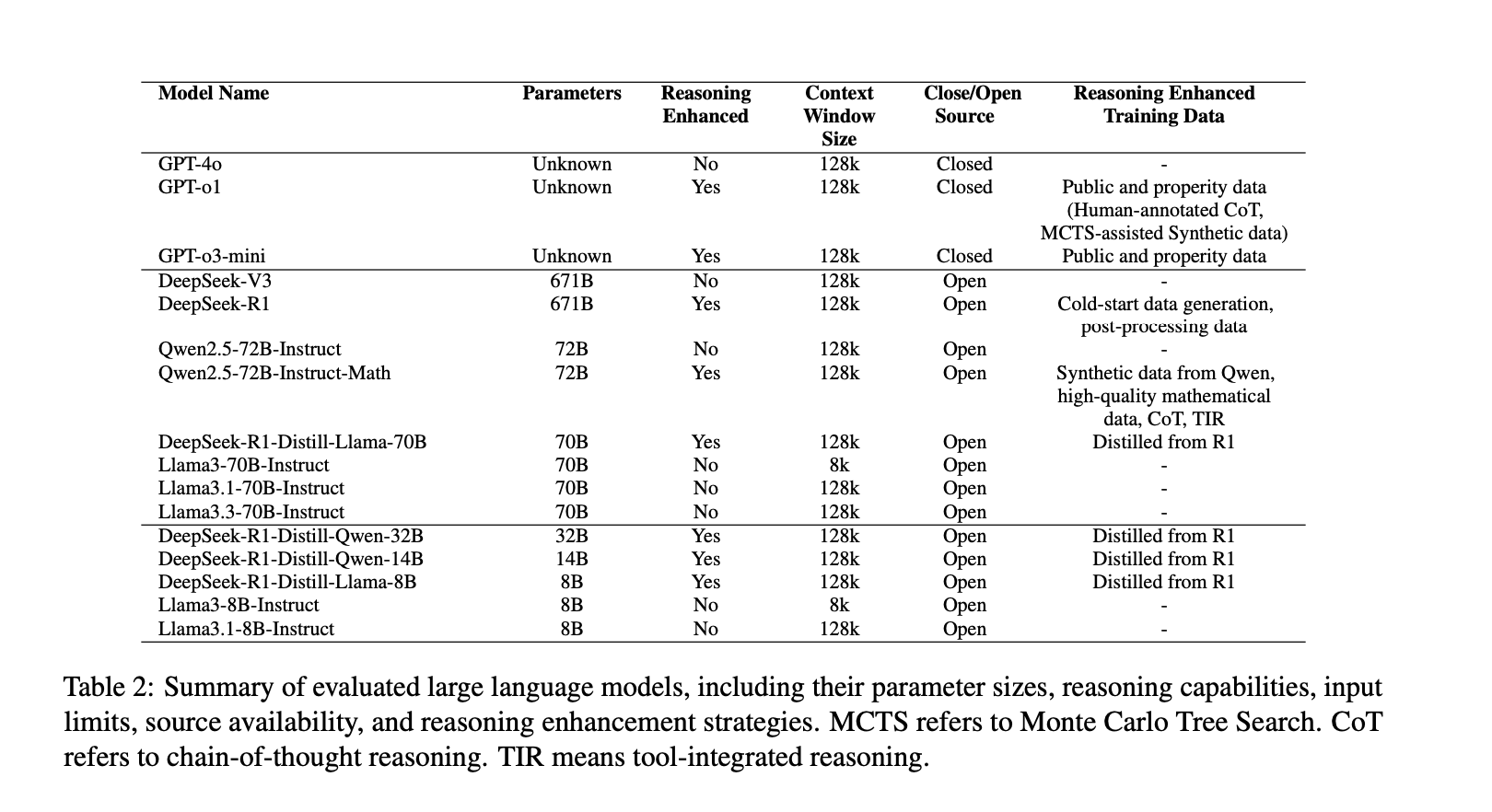

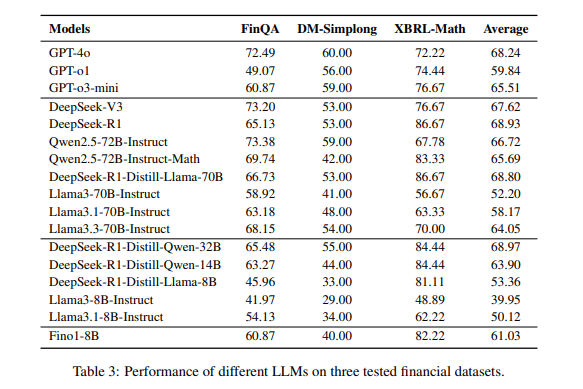

Researchers evaluated language models about financial reasoning tasks and found Deepseek-R1 performed best (68.93) Because of strong XBRL–Mathematics Results, followed by Deepseek-R1-Distill-Llama-70b and Deepseek-R1-Distill-Qwen-32B. GPT-4O Performed well but lags due to lower XBRL match scores. General models like Llama3.3-70b Compiled some reasoning focused models, which showed that general reasoning does not always improve financial tasks. Researchers found that logical assignment fine -tuned fine tuning with financial data while mathematical improvements were improved XBRL-MATH But wounded Finqa and DM-Simplong accuracy. Scaling of model size did not always help as smaller models sometimes priested better. Expansion of pre -formation data and refining techniques after training improved financial reasoning. Fino1-8btrained with reasoning paths from Gpt-4o, Over -justch to others, which proved that financial -specific education was effective. These results highlighted the importance of domain -specific education to improve economic understanding and numeric reasoning with multiple steps.

In summary, the new approach improved financial thinking in LLMS. By taking advantage of reasonableness paths from GPT-4O on FinqaAt Fino1 was 10% Better across three financial samples. Although formal mathematical models were best performed on numeric tasks such as XBRL-MATHThey fell under the expectations of treating financial text and long contexts, with domain adaptation needed. Despite the Model Scale and Dataset Diversity Limitations, this one can serve as a baseline for future research. Progress in expansion of data sets, retrieval reinforced methods and multi-step reasoning can further improve financial Llms for applications in the real world.

Check out The paper and the model on embraced face. All credit for this research goes to the researchers in this project. You are also welcome to follow us on Twitter And don’t forget to join our 75k+ ml subbreddit.

🚨 Recommended Reading AI Research Release Nexus: An Advanced System Integrating Agent AI system and Data Processing Standards To Tackle Legal Concerns In Ai Data Set

Divyesh is a consulting intern at MarkTechpost. He is pursuing a BTech in agricultural and food technology from the Indian Institute of Technology, Kharagpur. He is a data science and machine learning enthusiast who wants to integrate these leading technologies into the agricultural domain and solve challenges.